Michael Copp: Contractors must change their narratives to instill a sense of hope, mutual trust and loyalty

You are dealers in hope!

Image courtesy of ljubaphoto / E+ / Getty Images

Three things you need to know:

- Contractors must leverage a corporate culture of continuous learning by monitoring emerging confidence levels and address sources of customer reluctance;

- You are a dealer in hope when you give your customer a sense of optimism by anticipating their fear, tackling their needs while offering great value and meeting their concerns on their terms; and

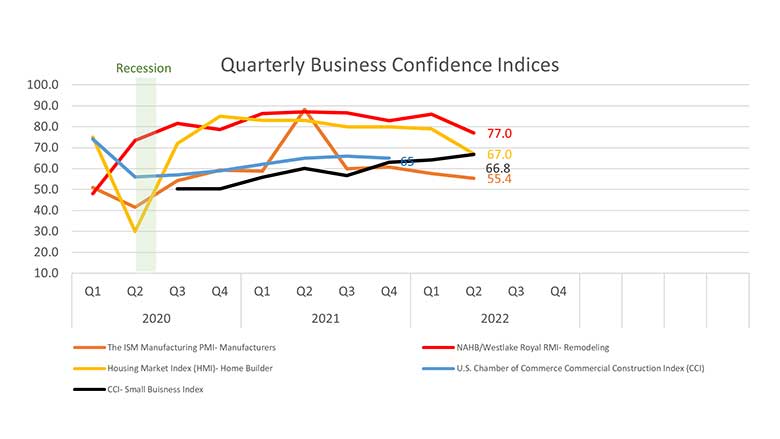

- Business confidence indices have dropped, but contractors can create a scorecard to assess each counterparty’s risk to their business and benchmark findings against competitors and other vendors to identify gaps they can then address.

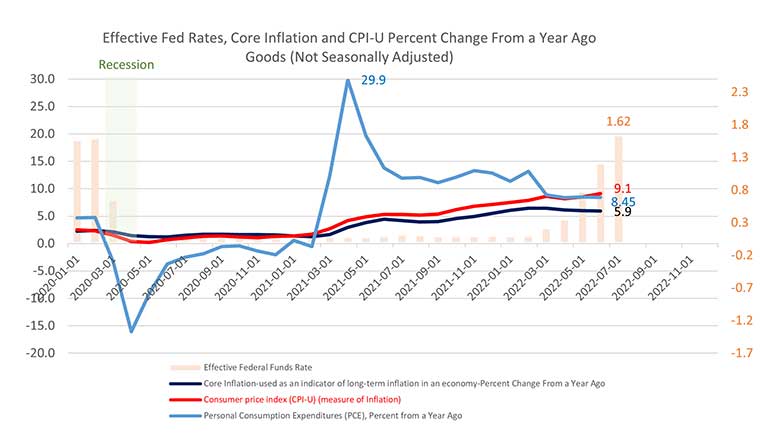

There has been a flurry of dire press reports regarding the June CPI-U (measure of inflation) climbing to 9.1% (as compared to an ideal rate of 2%). Consequently, the Federal Reserve continues several aggressive interest rate hikes, which now have driven the Effective Federal Reserve rate to a 1.62% monthly average, with several additional increases expected. One needs to go back to February of 2020 to see fed rates (1.58%) just below where they sit now — and prior to a brief two-month recession. And of course, it’s the fear of causing a recession that has the Fed carefully considering the amount of each rate hike — with the next one anticipated in September.

With the Personal Consumption Expenditures Price Index (PCE) (changes in the prices of goods and services purchased by consumers) dropping from 29.9% in March of 2021 (a year into the pandemic) to 13.8% in June 2021, and both the CPI-U and core inflation rates have climbed to 5.3% and 4.3%, respectively, in June of last year, one wonders why the Fed did not initiate inflation mitigation as was discussed back then. The answer is fear — fear of surprising investors, fear of slowing job recovery and fear of disrupting an economic recovery while opting to ride out short-term price volatility during a pandemic and now a war in Ukraine.

This was perhaps a case of doing the right thing over doing things right — though this is defined differently among financial and economic pundits. The Effective Federal Reserve Rate, for example, remained flat at 0.8% for almost two years before monetary policy changed this past March, which has now caused market volatility feeding palpable fear felt by many.

Image courtesy of Federal Reserve Bank of St. Louis

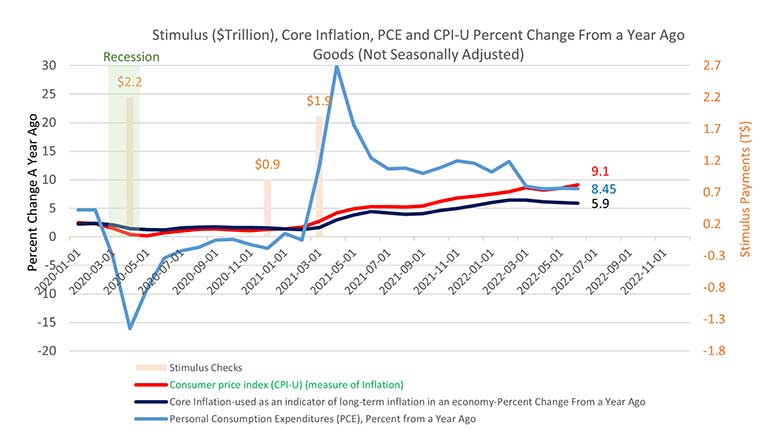

Image courtesy of Federal Reserve Bank of St. LouisIf we look back to the spring of 2020, we saw an intentional quelling of investor fears by propping up the market with the central bank purchasing $700 billion in government debt and until recently, continuing to buy $120 billion in bonds per month. Just prior to June 2021 discussions about fed policy changes, the government issued an additional $1.9 trillion in COVID-19 stimulus aid ($5 trillion in total) even though the unemployment rate dropped roughly in half from a high of 14.7% to 6% and the CPI-U rose to 4.2% (as compared to an ideal rate of 2%). The government ultimately spent a lot of money to do the right thing, but now, the economic underpinning attributable to past quantitative easing is being unlaced, untargeted stimulus payments have ended, and now government divestment of bond holdings are all eroding confidence and generating anxiety.

Image courtesy of Federal Reserve Bank of St. Louis

Image courtesy of Federal Reserve Bank of St. Louis

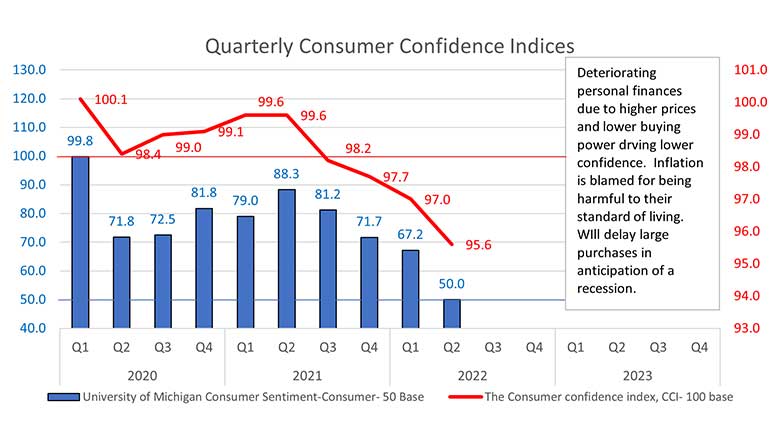

The Federal Reserve recently signaled that it would divest itself of bond holdings of $9 trillion to fight inflation, and of course, that has since caused higher borrowing costs and stock market volatility. This has caused an additional sense of fear amongst consumers watching their 401(k) values plummet while the cost of gas (up 60% albeit we’re seeing modest price declines in recent weeks), groceries (up 12%), and higher mortgage and refinance rates eat away at their savings, despite lower unemployment at 3.6% and job openings at 6.9% (construction job openings at 5.4%). Moody’s Analytics senior economist Ryan Sweet estimated that Americans paid roughly $500 more in June 2022 for household expenses including $78 in higher food costs.

Image courtesy of the Organization for Economic Co-operation and Development

Image courtesy of the Organization for Economic Co-operation and Development

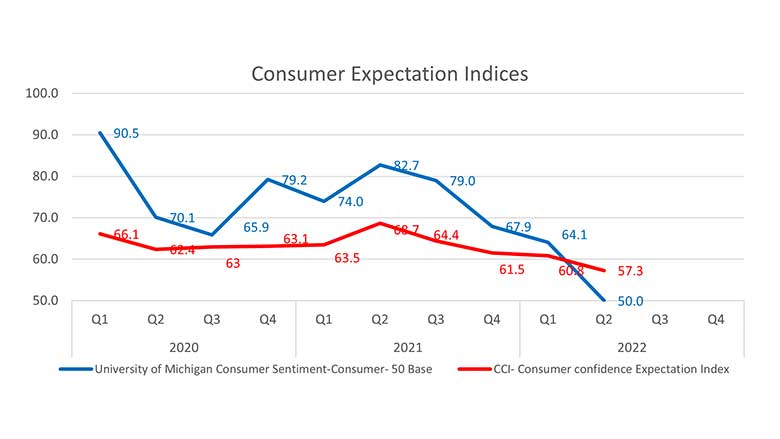

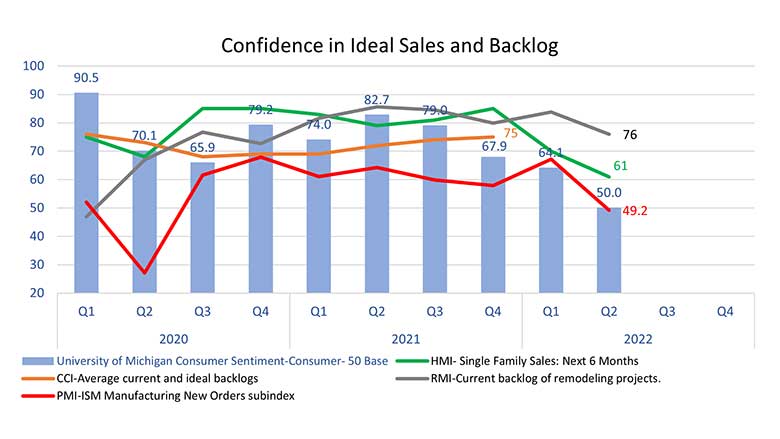

In turn, the consumer confidence expectations index plunged to 57.3 as the HMI’s new housing sales index dropped to 55 in July, and PMI’s manufacturing new orders index fell to 49.20 in June, underscoring the growing disparity between demand (about which the fed can help) and supply (about which the fed can do little).

Image courtesy of University of Michigan Consumer Sentiment Index

Image courtesy of University of Michigan Consumer Sentiment Index

Image courtesy of the Institute for Supply Management

Image courtesy of the Institute for Supply Management

Fear begets fear, and consumer confidence is very much an industry key performance indicator (KPI) that foretells the spending and savings patterns of customers and hence, representing potential risks for business owners. Causes cited for the drop in confidence amongst consumers include growing inflation, the war in Ukraine, China COVID-19 lockdown, higher interest rates, supply chain delays, economic uncertainty and recession fears, declining 401(K) values, and potential new COVID variants like BA.5. This erosion in sentiment is not helped by clickbait reporting of CPI-U lagging indicative data that shows high and climbing inflation based on transitory prices without balanced reporting about the ‘core’ inflation rate — used as an indicator of long-term inflation in an economy, that dropped since January 2022 to below 6% in June 2022.

Business confidence indices have also dropped with remodelers citing customer reluctance from supply chain delays and higher prices; home builders seeing delivery delays, higher construction costs and now, reducing sales prices; commercial builders noting lower revenue expectations and lack of skilled workers; and manufacturers seeing high demand, low supply and high employee turnover. What we need is a little bit of hope.

Image courtesy of the Institute for Supply Management

Image courtesy of the Institute for Supply Management

Napoleon Bonaparte observed that “A leader is a dealer in hope.” Consumer reluctance is an emotional reaction to a lack of control that stimulates a “fight or flight” response. Therefore, your narrative must seek to restore a rational evaluation of your product or service focused on solving a customer’s specific challenge and thereby, instilling a sense of hope, mutual trust and loyalty. Those wanting to do business with you are more likely to express their loyalty to other potential clients rather than customers feeling obligated to continue doing business with your company. This is critical to you and other p-h-c contractors who “live and die” by customer referrals.

The type of commitment that an individual inherently feels toward a business determines the degree of loyalty that individual feels for that organization. A customer can feel “affective” commitment: An emotional attachment to, identification with and trust for the organization. They may feel “continuance” commitment based on the costs that customer associates with disengagement. Customers who feel “normative” commitment simply feel obligated to stay with the organization. Intentionally building “affective” commitment will allow you to mitigate customer objections during the sales and engagement process in several ways that include:

- If customer reluctance comes from concerns about affordability, then consider offering third-party financing services, or bundling products and services with biannual maintenance, remote monitoring, leak detection into an annual service contract; and awarding loyalty points for additional services such as water heater flushes or HVACR equipment cleaning and calibration;

- If customers are concerned about general costs associated with the project, contractors might focus on how the solution solves the customer’s problem by highlighting value and benefits vs. product features;

- If customers are concerned about delays, then recognize supply chain challenges and share how your company provides realistic options that meet or exceed project requirements. Honesty, setting expectations and regular communication are keys to building a trusting relationship with your customer; and

- If customers are concerned about fuel costs, then maybe offer energy efficient equipment that offer the shortest return on investment, the lowest impact on the environment, and potential federal or state financial assistance programs and tax credits available to the customer.

Consider rehiring retired employees as part-time professionals and mentors to younger employees.

You are a dealer in hope when you give your customer a sense of optimism by anticipating their reluctance, tackling their needs while offering great value and meeting their concerns on their terms. Customers will remember and brag about your goodwill and great customer service appreciated during economic hardships hence, providing them a sense of hope.

Fear stems from uncertainty and business owners are not immune from feeling anxious — they need a sense of hope, too. Prices for frequently purchased plumbing and HVACR parts and products are generally up over 6% since February 2022, which precludes the contractor’s ability to eke out a modest profit to reinvest in their business. But as Andrea Hamilton (2020) sings in her song, Hope is in your Hands, “All you’ve got to do is what you can.”

To create a sense of hope for p-h-c contractors, Ezra Maddox (2020) in his article, 5 Steps to Protect Your Business Amid Economic Uncertainty, suggested that businesses “create a scorecard to assess each counterparty’s risk to [a contractor’s] business. Be sure to incorporate both quantitative and qualitative measures into the scoring system, and consider the following…” like [your] bank having an sufficient capital structure and technology infrastructure, your appetite for flexible payment options, your business’ diversity of product offerings, supplier and vendor confidential cyber data management and protection and vendor preparedness with alternate plans for supply chain delays. Contractors can then benchmark findings against competitors and other vendors to identify gaps that they can address.

Finally, Maddox (2020) suggests that contractors “reduce liquidity risk by … identifying available sources of primary and secondary funding.” He notes businesses can reduce operational risk and waste, develop a crisis action and business resiliency/ continuity plan, and, with a long-term view, continue to invest in employee training and software and hardware upgrades that increase employee retention, infrastructure security and customer communication. In short, you are building hope for you, your employees and your entire customer chain.

Hope is a movement of reimagining what your new rules of engagement can be — and then opening hope’s doors for business!

For more great information from the PHCC Business Intelligence Team, check out www.phccweb.org/membership.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!