Nicole Krawcke: Home service industry rebounds after the pandemic

New report from Jobber shows consumer spending on home services — including plumbing and HVAC — has exceeded pre-pandemic levels

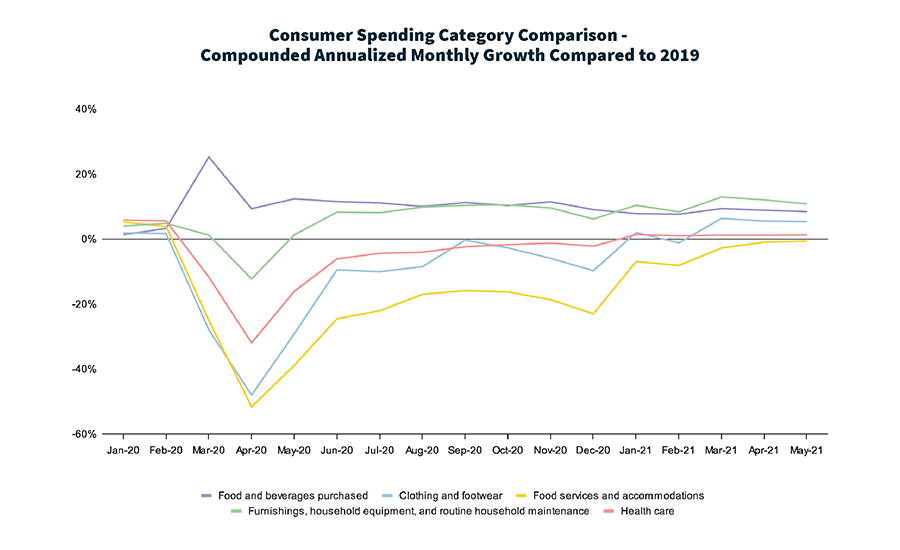

There’s no doubt the COVID-19 pandemic affected businesses of all types and sizes. However, as the economy continues to recover in 2021, different categories are rebounding at different rates. The home service category demonstrated its resilience and stability throughout 2020, and into the first half of 2021, according to a new report from Jobber, a provider a home service management software.

The Home Service Economic Report: 2021 Mid-Year Review, released in August, features data aggregated from more than 100,000 home service providers, including plumbers, HVAC technicians, electricians and construction contractors. The report finds that consumer spending on home services — including plumbing and HVAC — recovered faster than all other categories and has exceeded pre-pandemic levels from June 2020 onwards.

“The Home Service category has demonstrated resilience throughout the pandemic and continues to experience positive growth,” said Sam Pillar, CEO and co-founder of Jobber. “While factors such as growing inflation and supply chain disruptions are presenting challenges for companies everywhere, key indicators point to consistent growth for home service as we enter the second half of 2021.”

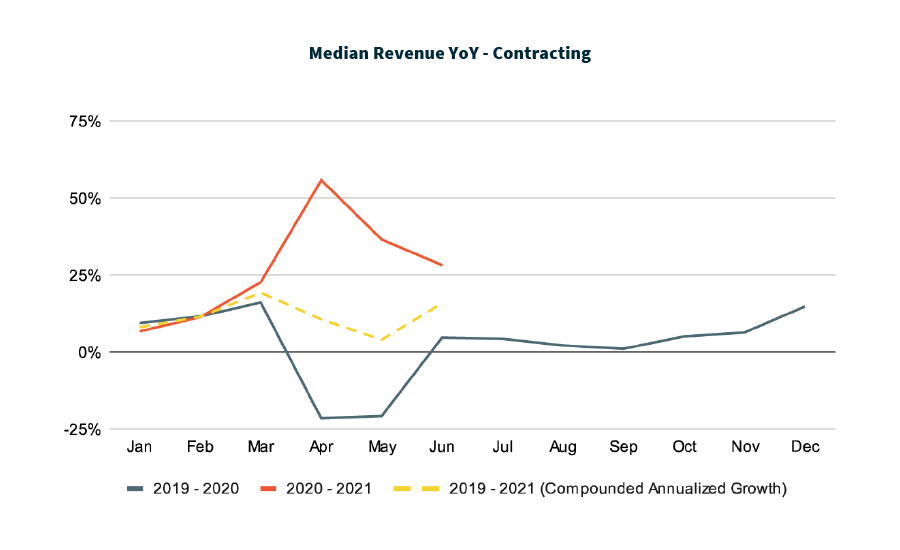

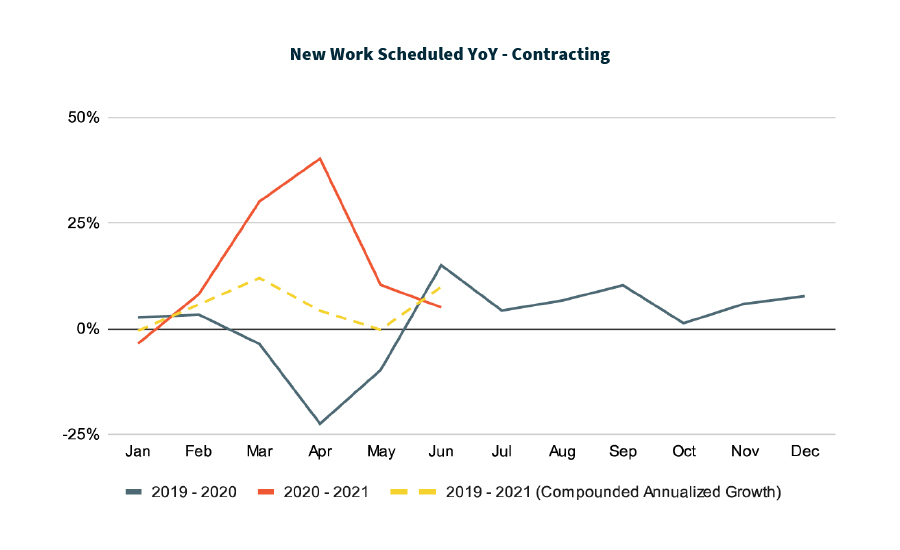

Though contracting was significantly affected by the first wave of COVID-19 last year — people did not want strangers entering their homes during the height of the pandemic — the segment rebounded much faster than others.

“Contracting ended 2020 on a high note, and that high growth trend has continued into this year,” the report states. “Both new work scheduled and median revenue have ended Q2 on a healthy note, so things are looking positive for this segment for next quarter.”

Here are four key takeaways plumbing and heating contractors should consider from the report.

1. New and existing home sales reach record levels

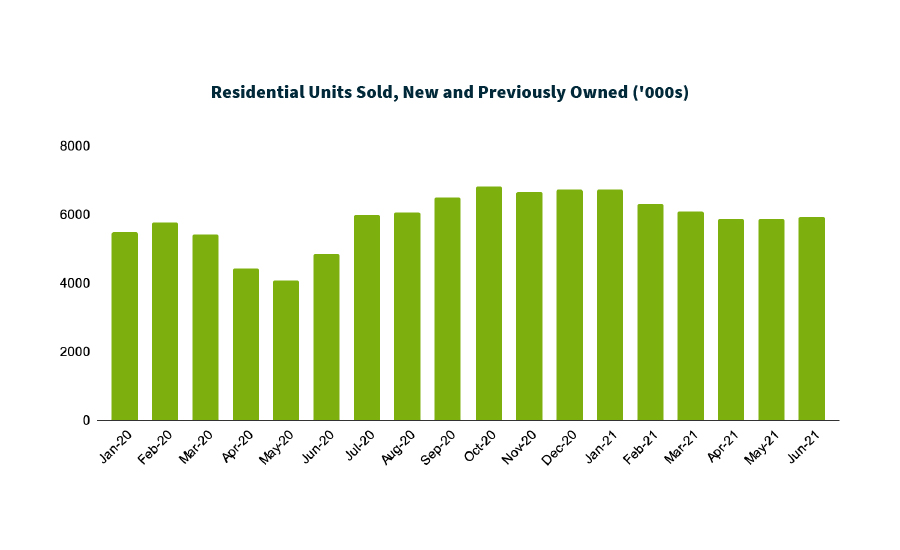

As the report points out, the health of the home service industry is closely tied to the residential housing market. A rise in sales means increased demand for home services, including plumbing and HVAC contracting services. Though the pandemic caused a slight decline in the housing market from April through June 2020, the sale of new and existing homes recovered very quickly, reaching record levels in the second half of 2020, and into Q1 of 2021, according to the report. Sales dropped only slightly in Q2.

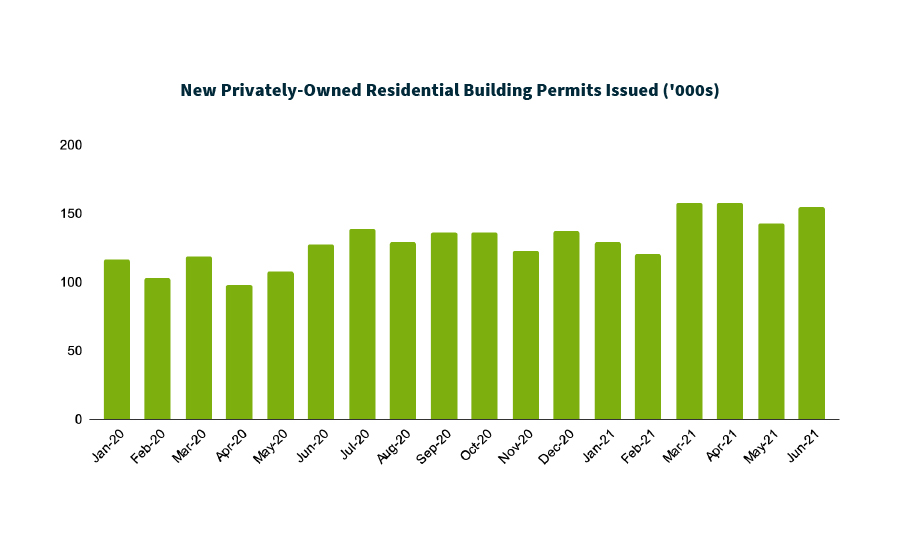

2. Home renovations still booming

According to the Jobber report, the home remodeling market is stronger than pre-pandemic levels. Of course, the enforced pandemic lockdowns and shutdowns have forced people to spend more time at home than ever before, leading to a rise in all types of home renovations, especially kitchen and bathroom.

“According to the Leading Indicator of Remodeling Activity (LIRA) released by the Joint Center for Housing Studies of Harvard University, the annual growth in home renovation and repair expenditure reached 6.1% year-over-year growth in Q2 2021 and is expected to grow by 7.6% by the end of 2021,” the report states.

Additionally, there has been growth in new building permits issued throughout the second half of 2020 and into 2021.

“The trend is shifting from DIY home improvements to professional renovations, as more homeowners feel comfortable inviting contractors back into their homes,” the report says.

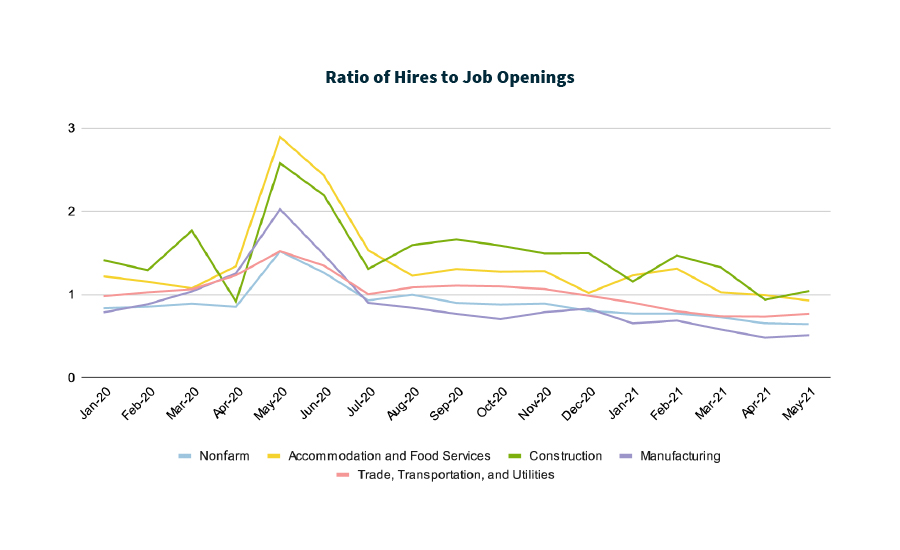

3. Labor shortage still impacting contractors’ ability to take on more work

While the overall U.S. unemployment rate has improved in 2021, the recovery rate for home service businesses is better than other categories, Jobber found. The ratio of hires to job openings has decreased, suggesting there is the desire to hire more workers and not enough workers to fill them. I know this comes as no surprise to the industry pros reading this right now.

“We know from conversations with our customers that hiring workers is incredibly challenging, particularly now,” Pillar says. “Our data also reinforces that businesses are struggling to hire workers in many home service industries to meet customer demand. If you’ve ever considered pursuing a career in home services, now is the time.”

“A skilled workers shortage is an industry challenge that will continue to impact the home service category,” adds Abheek Dhawan, vice president of business operations at Jobber. “It’s more important than ever for businesses to embrace technology like Jobber to better manage jobs, improve communication with customers and make their existing teams more efficient.”

4. Increased demand, supply chain disruption force construction delays

The rise in consumer demand combined with pandemic-related supply chain issues have created many challenges for contracting businesses.

“In addition to labor shortages, producer price index (PPI) for net input to construction industries (goods) have soared as a result of scarcity in the face of increased demand,” the report states. “The PPI for lumber and wood soared 50% by June 2021 compared to January 2020, while PPI for steel mill products increased by 82% during the same period. Diesel, which experienced a 50% decline compared to Jan 2020 in May 2020, observed a complete shift and increased by 46% compared to January 2020.”

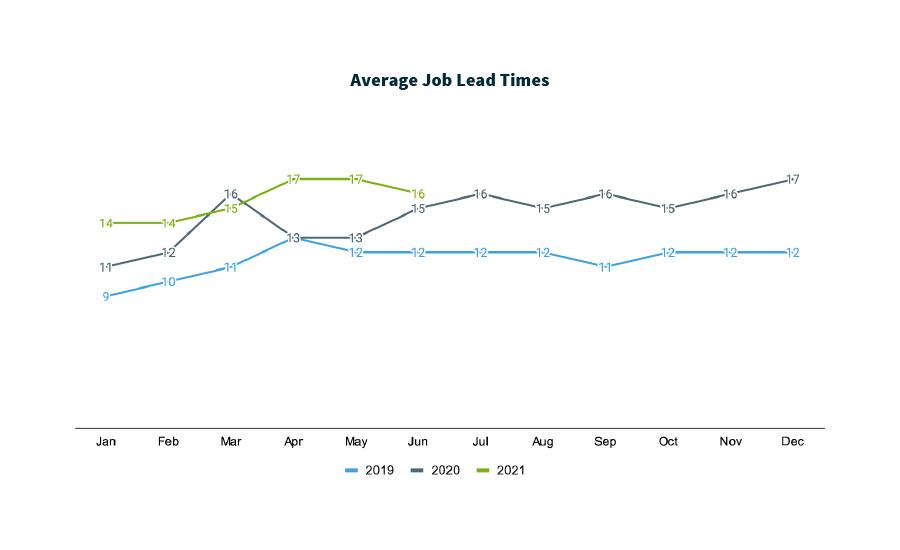

These supply and demand issues have caused numerous construction delays, according to Jobber. The report cites external data indicating the average wait time for the overall construction industry to start a project is up by almost four weeks in Q2 of 2021 when compared to the same period in 2020.

“According to our data, the average job lead times are at an all-time high and up by four days in Q2 2021 compared with the same period last year. Service providers are getting more job requests than they’re able to fulfill," Jobber noted.

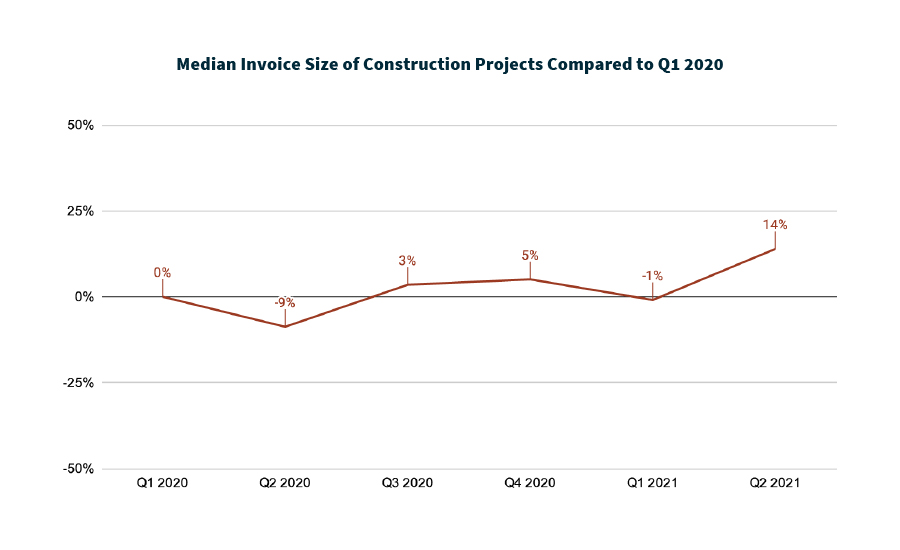

Additionally, higher material costs are causing contractors to raise their own rates, increasing the average invoice size. According to the report, median invoice size grew by 14% in Q2 2021 compared to pre-pandemic levels of Q1 2020.

“Altogether, these dynamics have led to mixed results for the construction industry,” the report says. “After healthy growth in new work scheduled throughout the second half of 2020, new work growth in 2021 has been quite volatile. Similarly on the revenue growth side, last quarter saw quite a slowdown in CAG since 2019 after a healthy Q4 2020 and Q1 2021.”

Future outlook

These trends will more than likely continue during the second half of 2021, allowing the home services market to continue its steady growth.

“The employment recovery in home service, albeit slow, is better than most other categories,” the report concludes. “As consumer demand for home service grows, the shortage of skilled workers will continue to impact the ability for businesses to meet this demand. This, in addition to higher material costs, are challenges that will likely continue for the rest of the year. Unfortunately, the COVID challenge still persists, with a rise in delta variant cases, and a general rise in cases overall. Although vaccinations that have already been distributed are expected to help with this new wave, the impact on society as well as the economy is hard to predict. That said, many home service businesses have been able to navigate through the previous waves, and will be able to draw on that experience moving forward.”

Either way, plumbing and HVAC contractors need to be prepared. Economic reports like Jobber’s are a great tool for managing your business and planning ahead. To view the full report, visit https://getjobber.com/home-service-reports/august-2021.

Graphs courtesy of Jobber. Hero image: LockieCurrie/E+ via Getty Images

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!