PHCC releases Second Quarter 2023 Contractor Confidence Index Report; industry conditions improve despite ongoing concerns

Plumbing-heating-cooling contractors feel that industry conditions are better now than they were in the previous three months, according to the latest report from the Plumbing-Heating-Cooling Contractors—National Association. The PHCC Business Intelligence Department just released its Q2 2023 Contractor Confidence Index (CCI). Sponsored by PHCC Strategic Partner Bradford White, the PHCC CCI is based on a quarterly survey of PHCC members designed to take the pulse of the plumbing, heating, ventilation, and cooling market.

The PHCC Second Quarter 2023 CCI summary report revealed a CCI of 56.2 (any rating over 50 indicates a higher share of PHCC contractors reporting industry conditions are better than they were in the previous quarter). This CCI is up from 52.2 in the first quarter, although respondents cited ongoing frustrations as well as concern about an impeding recession.

The number of plumbing contractors reporting concerns about a recession rose sharply by 25%, as did the number of respondents experiencing customers holding off on projects and replacements. Over half of respondents saw increased operational and material costs, and just under half were experiencing shipping delays, as well as parts and equipment shortages from suppliers and manufacturers.

Participating p-h-c business owners expressed disappointment about sagging sales closing rates. Respondents also noted that general contractors are taking longer to pay for work performed, as well as holding project retainages for a longer period of time. Concern was also expressed about significant delays from design teams in producing contract documents on most projects.

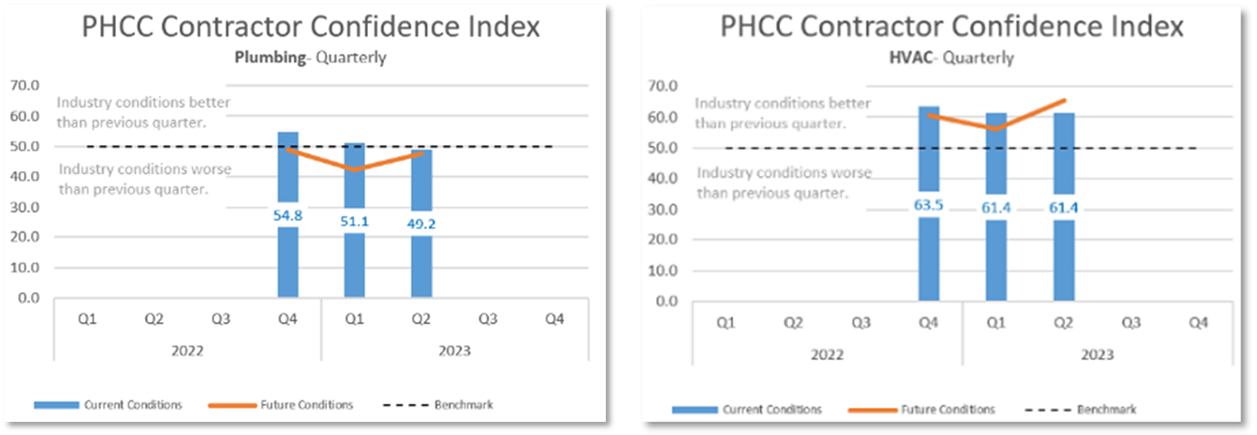

Plumbing-only contractors specifically reported a confidence index of 49.2%, versus 61.4% for HVAC-only contractors. This breakdown follows the trend of the past few indices, with HVAC contractors consistently reporting higher confidence than plumbing contractors.

Top contractor challenges found in the report included:

- Finding & hiring trained and skilled employees for both plumbing & HVAC;

- Inflation, lower ROI, high diesel prices, high costs for new construction and remodeling;

- Increased operating costs due to increased cost of living and increase in material costs;

- Difficulty getting equipment repaired on a timely basis; and

- Availability issues with materials and high/rising costs of insurance.

While roughly 62% of PHCC contractors anticipated normal to better sales in the future, 40% of them are not operating with full staff, employees, and technicians; down even further from 47.1% in the first quarter. About 68% of respondents reported rising costs, and 40% of respondents noted delays in shipping materials.

Looking ahead, 71.1% of the CCI respondents are anticipating increased costs of doing business (parts, materials, labor), and more than half of the total respondents are worried about an impending recession, as well as continued challenges finding qualified employees and technicians.

The top concerns that contractors reported regarding the next six months included staffing and finding qualified applicants, continued disruptions with oil boiler heating products, and further supply chain issues.

Disclaimer: The PHCC Contractor Confidence Index (CCI) is based on a quarterly survey of PHCC members designed to take the pulse of the plumbing heating and cooling market. The survey asks respondents to rate market conditions for the present time and for the next six months. Survey results and the PHCC CCI were developed as a general sense of contractor sentiment and should not be used as a guaranteed indication of future performance of the economy and industry. Many PHCC Contractors provide both plumbing and HVAC installation and service.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!