Growth in European Hydronic Controls market set to sprint

BSRIA’s latest findings are from a study of five major European markets

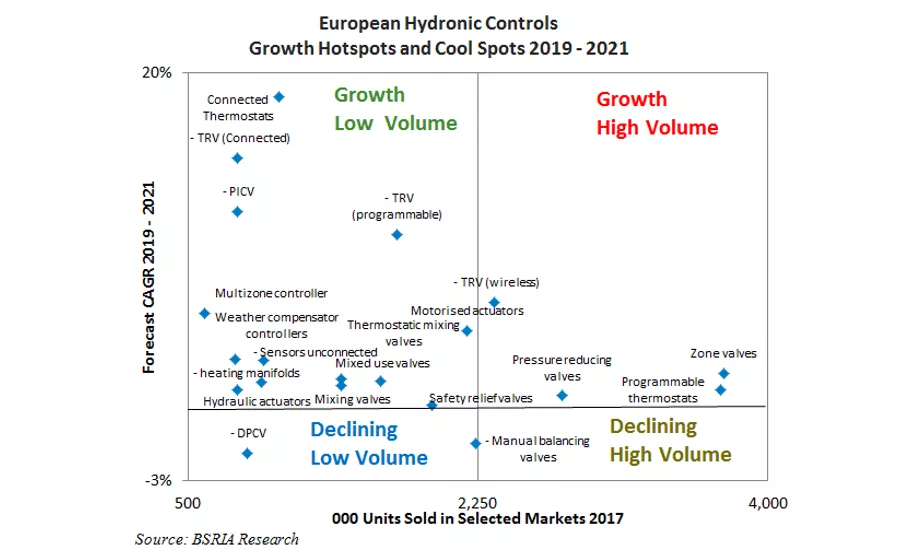

Connected thermostats, connected thermostatic radiator valves (TRVs) and pressure independent control valves (PICVs) will be the biggest growth drivers in a generally rather “patchy” European market according to BSRIA’s latest study of the hydronic controls market in five major European Markets, published in February 2018.

These key findings are from a study of five major European markets: France, Germany, Italy, Poland and the U.K. The studies cover all valves, actuators and hydronic controls (such as sensors and thermostats), for both the residential and commercial markets.

BSRIA forecasts that the value of the market for connected thermostats is set to grow in 2019-21 by between 14.8% CAGR in Poland and 26% CAGR in the U.K. Germany, France and Italy are forecast to show growth between these figures. This is being driven by the rapid growth in uptake of smart home solutions and by the desire of consumers in particular to have remote access to their thermostats so that they can have more control over their heating, comfort and energy consumption.

Connected TRVs are forecast to grow by between 3% CAGR in Italy and 28% CAGR in France, offering control at room level with a device that many users can fit for themselves.

The market for PICVs is predicted to continue its robust growth, with market value in 2019-21 forecast to increase at just under 10% CAGR in France and Poland and almost 15% in Germany and the U.K. This reflects the interest of the commercial sector in managing hydronic systems more efficiently.

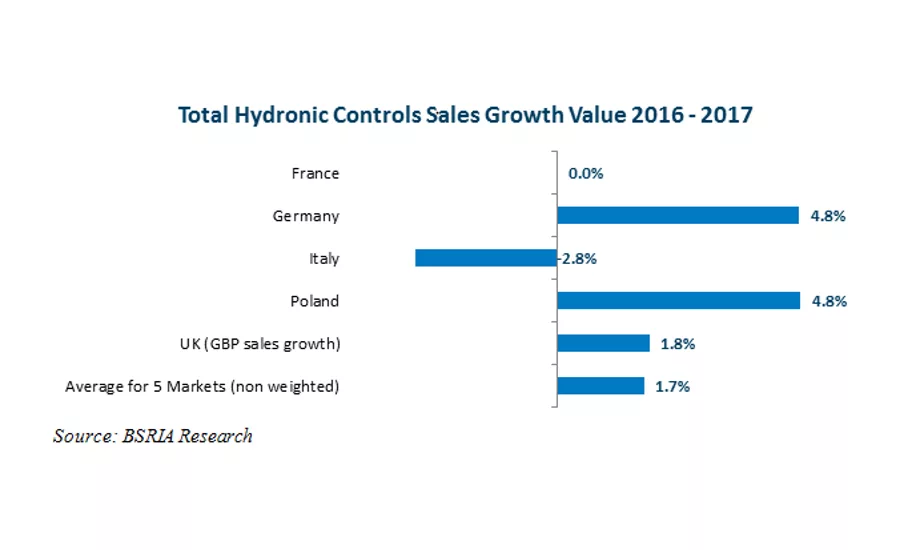

Germany and Poland both experienced significant growth in overall hydronic controls market value in 2016-17. In Germany, this reflects a strong economy and a robust residential construction market.

A key factor in the growth experienced in Poland is the rise in building standards.

In France the market was flat, while in Italy it declined overall. However, the decline in Italy was driven by a major drop in TRV sales in 2017 following regulatory changes, as all other categories have witnessed growth. In the U.K. the market saw weak growth in sterling value, but declined when measured in Euros, reflecting a difficult “political and economic situation.”

Germany remains, by far, the biggest hydronic controls market with a total product value of over 1 billion euros in 2017, with the U.K. second with just over half that value, followed by Italy. The French market is comparatively small, partly reflecting the strong penetration of electric heating in the French residential market.

In most markets the value of the actuator market is increasing faster than that for valves, reflecting the demand for more sophisticated actuators. Manual control valves and manual radiator valves are forecast to decline in most markets, as are manual thermostats.

“Indeed, these studies confirm two fundamental facts about the European hydronic controls market," WMI Senior Market Research Consultant Henry Lawson said. "The first is that it is a mature market which broadly tends to grow or decline in line with the construction industry combined with economic conditions in a given country.

"The second — and more exciting fact — is that hydronic controls are being strongly influenced by the general demand for smarter and more connected controls, linked to the growth of the Internet of Things in general and to the movement towards smarter buildings and smart homes in particular.

"These reports shine a light on this important trend.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!