Home tub trends

In multigenerational homes, bathtubs provide children and the elderly a safer and more comfortable alternative to showers.

Multiple online surveys show that more people take showers than baths. However, the bathtub is still a fixture in many homes, the focal point of the bathroom. In multigenerational homes, bathtubs provide children and the elderly a safer and more comfortable alternative to showers.

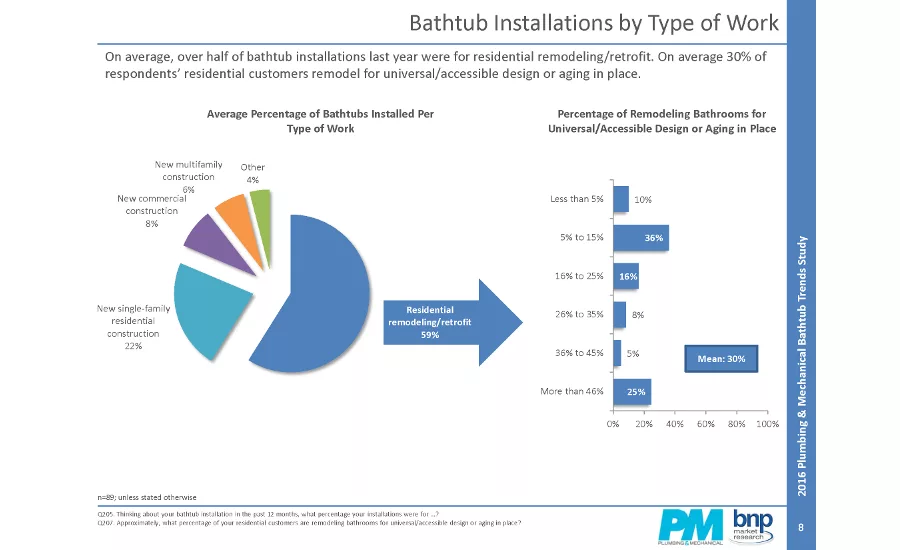

The National Kitchen & Bath Association 2015 trends report identifies bathroom remodeling in the $10,000 to $30,000-plus range. Plumbing & Mechanical surveyed its readers earlier this year to find out bathtub design and installation trends in the industry. On average, survey respondents say nearly 60% of bathtub installations last year were for residential remodeling/retrofit purposes, with 22% in single-family new construction.

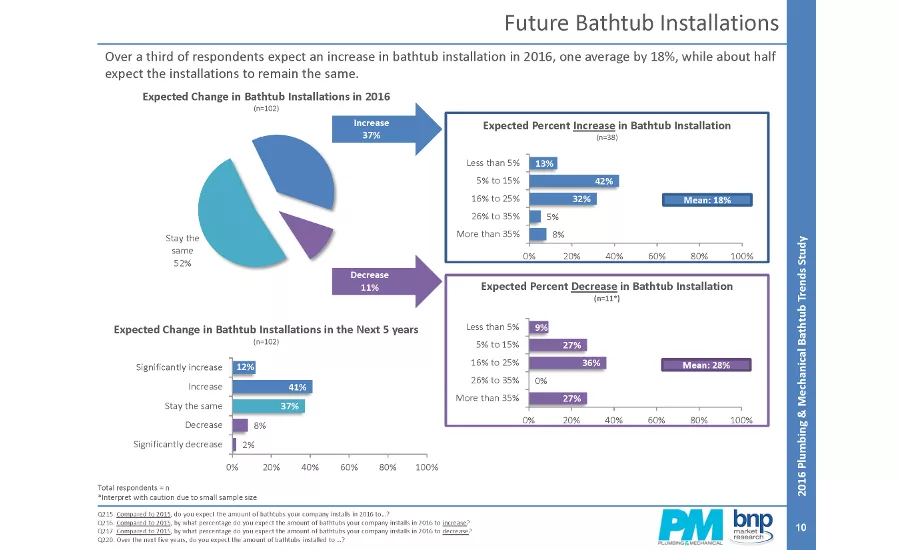

Plumbing contractors indicate that bathtub installations account for 13% of the total sales for each company. More than a third of respondents expect an increase in bathtub installations in 2016, on average by 18%, while about half expect the installations to remain the same. When looking at the next five years, more than half (53%) expect tub installs to increase.

Nearly 60% of the bathtubs installed include drop-in/platform (59%), whirlpool/air baths (57%), and freestanding (57%), while roman/soaking tubs are 51% of installs. “Deep soaking tubs are gaining some popularity for the therapeutic aspects after a brisk workout or for relaxation,” says Bill Strang, president of operations for the Americas, TOTO.

Drop-in tubs may be the most common type of installation because of space constraints in many residential bathrooms. “A drop-in allows the designer to use wall space, which is great for an alcove installation or setting in a deck,” says Lynn Hardy, operations manager for Americh Corp. “In most homes it is typically only the master bath that may have a unique installation.”

As the survey results suggest, freestanding bathtubs are in high demand. “Freestanding designs serve as eye-candy while additional experiences added to a freestanding bath will appeal to the avid bather,” says Kristina Spindler, director of marketing at Jacuzzi Luxury Bath.

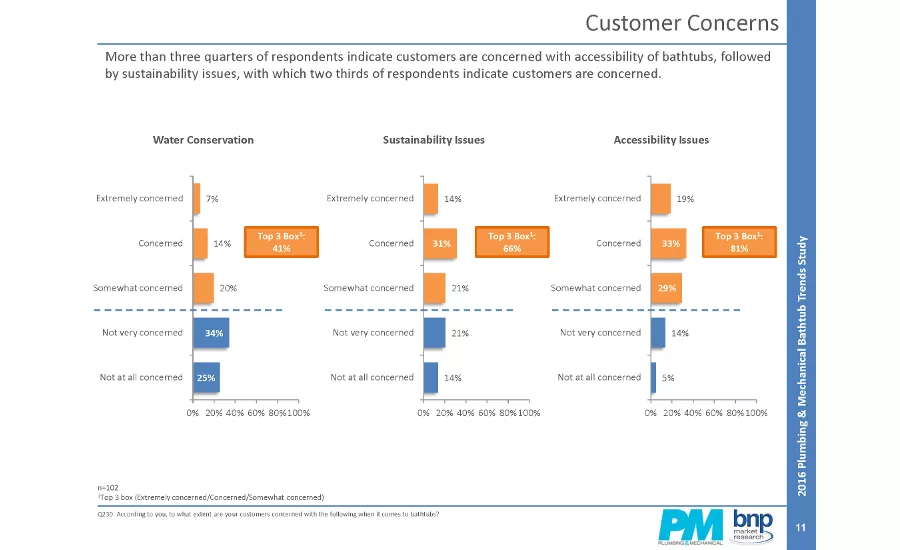

Walk-in tubs, used in aging-in-place and universal design applications, were installed in about 36% of plumbing contractors’ projects. The majority of respondents (81%) indicate their customers are concerned with accessibility of bathtubs, and one-third of respondents’ residential customers remodel for universal/accessible design or aging in place.

Baby boomers are the majority of remodelers and are behind the aging-in-place movement; they have a high disposable income and are more aware of accessibility and safety issues. As the baby boomer demographic gets older, manufacturers have seen increased interest in walk-in tubs, as well as hand showers attached to tub spouts/fillers to provide greater flexibility in the bathtub.

“I believe there will be a focus on tub designs that are compatible with multigenerational households, universally designed bathrooms and an increasing aging population — products that will be beautiful and at the same time versatile, comfortable and safe,” says Michael Kornowa, MTI Baths director of marketing.

The majority of installed bathtubs are made of fiberglass (83%) while more than half use acrylic (69%) or enameled cast-iron (60%). Other materials include: solid surface/resin (44%), enameled steel (40%), cast-polymer (32%), marble (14%) and copper (10%).

Some manufacturers see a trend toward space-saving and modular configurations that give contractors more versatility and flexibility. “The overall look of bathtubs are trending toward simple and sleek designs,” says André Deland, vice president of new product development and marketing, MAAX Bath. “Tub decks are getting thinner, and edges are more angular and structural.”

These trends can shift in smaller bathrooms. “Given the number of freestanding tubs installed in very small bathrooms, expect to see an increased offer of tubs which are freestanding on three sides only — the long back side against the wall,” explains Jacques Farmer, Aquabrass director of product development. “This configuration typically increases space in front of the tub by at least eight inches.”

Thirty percent of contractor-respondents installed at least one of the following tub accessories in the last year: digital controls (27%), aromatherapy (13%), chromotherapy (10%) and music (7%). With more people comfortable using smart devices, it’s not surprising that the digital revolution has invaded the bathroom — in tubs, showers and even toilets.

“We’re getting requests for bath products that do more for stressed out individuals,” notes Haley Davis, product manager for Mansfield Plumbing. “The options we offer in many of our tubs — from inline heaters that maintain water temperature to chromotherapy mood lighting that changes the water color — are all increasing in popularity with purchasers.”

Sustainability and water conservation issues surround the use of bathtubs vs. showers. Two-thirds of respondents indicate that customers are concerned with sustainability issues and almost half (41%) replied water conservation also is a homeowner concern.

Tubs will almost always use more water than a shower. A typical shower with a 2.5 gal. per min. flow rate for a 15-min. shower is about 37.5 gal. A 5-ft. tub has about a 50-gal. capacity, a 6-ft. or larger tub is in the 70- to 80-gal. range. However, there are some water-saving options, such as waterless massage technology.

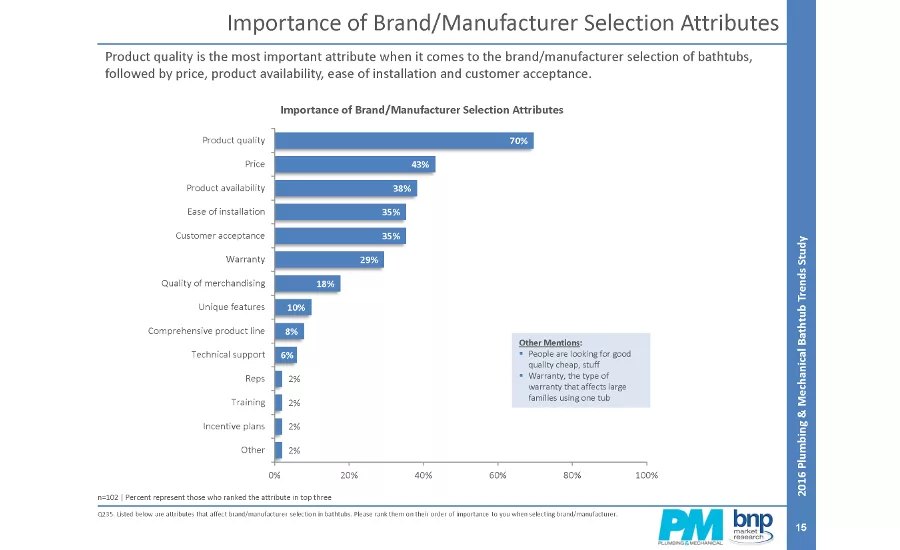

More than half of contractor-respondents says they influence the bathtub brand purchase by the homeowner a majority of the time. Nearly 60% of respondents have installed two to three brands of bathtubs in the past 12 months. Product quality (70%) is the most important attribute when it comes to the brand/manufacturer selection of bathtubs, followed by price (43%), product availability (38%), ease of installation (35%), customer acceptance (35%) and warranty (29%).

The least important attributes for plumbing contractors are incentive plans, training, manufacturer reps, technical support and comprehensive product line.

Plumbing wholesale distributors are the main source for contractors to purchase bathtub fixtures for most installations (92%). Purchases from bath-and-kitchen showrooms and hardware stores come in at almost a third each (29%), followed be internet sites (15%) and direct from the manufacturer (14%). A third of respondents installed the bathtub the homeowner purchased without influence from the contractor.

In order to make these recommendations, more than three-quarters of respondents rely on manufacturer websites to gather information about bathtubs (79%); about half or more obtain it from in-person events/trade shows (55%) and/or trade magazines (47% print, 42% website and 37% digital editions). Other sources include search engines (40%), virtual events/trade shows (32%), newsletters (19% mailed and 17% digital), webinars (9%) and social media (8%).

For residential customers, it all comes down to the best bathing experience that works within their budgets. “We believe consumers seeking out bathtubs are looking for an enhanced experience in bathing,” Davis says. “They’re eager to add in bonus features that make the time they invest in the bath even more pleasurable.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!