Brad Williams: Buy to sell

Making strategic buying decisions today to benefit your company in the future.

mapodile / E+/ Images via Getty Images

The benefits of buying companies are vast. In this article, I will explore the reasons for buying a company today that will benefit your company in the future. There is an entire industry built around the idea of “buy to sell,” — private equity.

Many of the people reading this today are strategic plumbing distribution owners/operators. Without going into too much detail, plumbing distribution wholesale businesses are selling from 4.5-7x EBITDA for companies under $50 million, while the larger plumbing wholesale businesses are selling for 6-7x+ EBITDA. If you are a larger plumbing wholesale company, buying a smaller wholesaler will immediately be accretive to the value of your business.

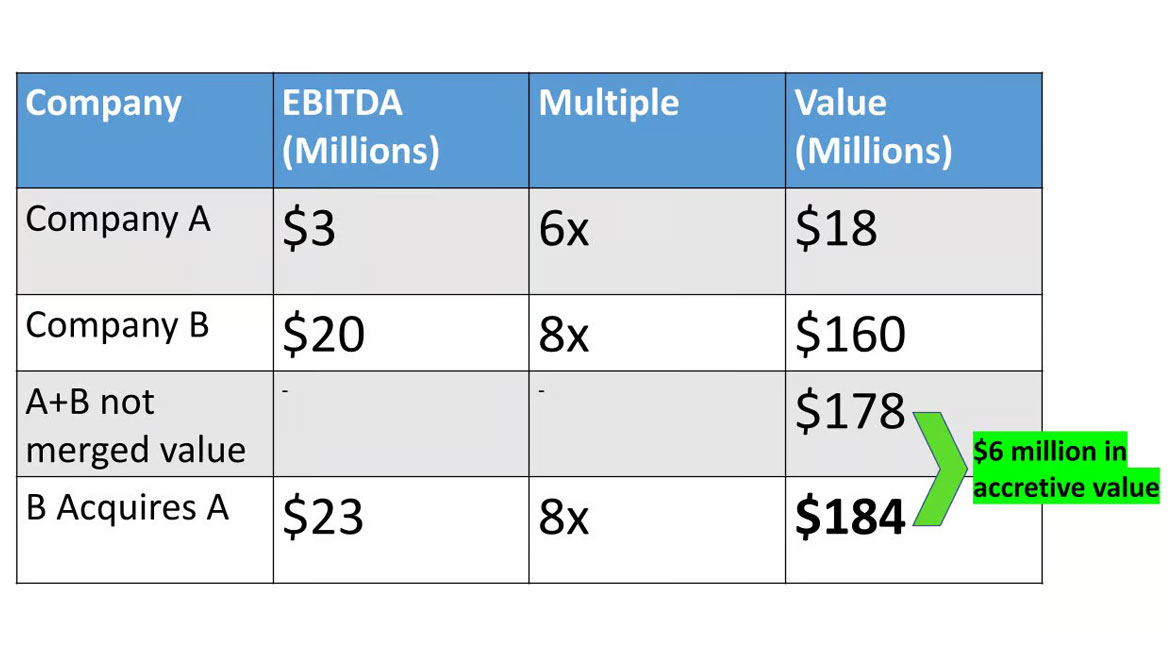

That term “accretive” is essential to truly understanding why it is important for a company to grasp the concept of buying to sell. The term accretive is an adjective that refers to business deals that result in a company’s gradual or incremental growth in value. I will lay out an example to help paint this picture. We will assume that Company A does $3 million in EBITDA, and sells at a 6x multiple. Company B, who does $20 million in EBITDA, will garner an 8x multiple. The value proposition for Company B buying Company A is that Company B will realize immediate value by buying Company A. This is because Company A will now be part of Company B and the EBITDA that was associated with Company A will now sell for Company B’s multiplier.

Let's say you buy a company that does $3 million in EBITDA. You will immediately see the value of that purchase reflected in your own EBITDA, meaning that you just grew your company by three million dollars in EBITDA. That added value from acquiring is shown in the graph.

Here are an additional four reasons why “buying to sell” could be beneficial to your company.

BIGGER COMPANIES = BIGGER MULTIPLES

Not everybody knows that larger companies get bigger multiples when looking to sell. In our experience bigger companies receive higher bids/offers.

The reason? Larger companies have more infrastructure, systems, and processes, along with better purchasing power.

SYNERGIES

Acquiring smaller companies can provide synergies in areas such as supply chain management, distribution and marketing, leading to improved efficiency and increased profitability.

Smaller companies may have cutting-edge technologies and talented individuals that can help the acquiring company stay ahead of the competition.

REMOVE COMPETITION, HAVE BETTER PRICE CONTROLS

Buying smaller companies removes the competition in your current market.

Removing competition allows companies to set their prices and better control the market, which leads to company growth.

Acquiring smaller companies can help a company increase its market share and achieve better purchasing power. This also leads to a bigger barrier to entry for competitors.

DIVERSIFICATION

By acquiring smaller companies, a company can diversify its product offerings, customer base, and geographic reach, reducing its exposure to market fluctuations and increasing its stability.

“Buying to sell” can have many different positive effects on your company and is something to be considered next time you sit down to consider the state of your business and your five to ten year business plan.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!