Material Expenses

Unfortunately, there could more bad reasons than

good for an increase in such expenses.

If you are like many plumbing and heating

contractors, you have seen your material expense line in your P&L statement

grow in recent years. I hope this is due to expanding sales. However, it could

be for more sinister reasons. Let’s take a deep dive into the material expense

line and see if any of this sounds familiar.

If you are like many plumbing and heating

contractors, you have seen your material expense line in your P&L statement

grow in recent years. I hope this is due to expanding sales. However, it could

be for more sinister reasons. Let’s take a deep dive into the material expense

line and see if any of this sounds familiar.

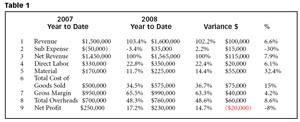

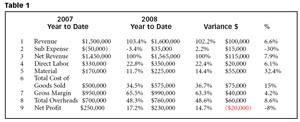

You’ll find a condensed P&L statement in Table 1. Let’s diagnose what is going on with this company.

If you look at the upper right corner of line 3, you will see that net revenue is up 7.9 percent or $115,000 over the prior year. So far, so good. The old business adage, “If you aren’t growing, you are dying,” is especially true in the service business.

The next stop is direct labor. You can see at the end of line 4 it is up only 6.1 percent. Along with revenue growth, this is more good news. We are gaining leverage on our direct labor expense. In other words, we’re becoming more efficient in the field. Direct labor as a percentage of sales is a healthy 22.4 percent, down slightly from the prior year’s 22.8 percent. So top-line revenues are moving up and labor percentage is moving down. I like it so far.

Let’s look at material. In 2007, material on line 5 represented 11.7 percent of sales. This year it has grown to 14.4 percent. So while revenues are up 7.9 percent, material expenses are up 32.4 percent. Yikes!

Now let’s see what this increase in material expenses has done to profitability.

Reviewing total overheads on line 8, you will see that they have gone up 8.6 percent year over year, just slightly more than revenue growth. This is pretty much in line. For the purposes of this example, I have condensed all these expenses that are typically segregated into many different expense categories such as vehicle expenses, overhead salaries, etc.

The net result, however, is the company made $20,000 less in profit (line 9), despite growing the business and keeping labor and overhead costs in line.

A lot of hard work went into growing the business and managing labor expenses (two very difficult tasks), only to give it all back plus $20,000 all on the material line.

Does this sound familiar? It is happening across our industry in recent years - material costs rising faster than sales and eating into company profits. How can this be?

Here are some possible reasons:

1. Material cost increases are not being fully passed on to the consumer in the form of higher selling prices.

This is the No. 1 reason for increased material percentages on the income statements I review. For several years, prices for common products such as copper pipe, PVC, fixtures, boilers, you name it, have risen dramatically. It seemed that contractors were getting price increases with every material order.

Compounding this problem is the flat rate pricing method used by most service companies. For many contractors, printing a new flat rate book is a time-consuming task. As such, it is done maybe twice a year - usually when all the existing copies are dog-eared and dirty or stolen by former employees. The result is contractors are using last year’s material expenses to build this year’s selling prices. A big problem.

Another mistake I have seen with flat rate contractors is that when they do print new books, they may just take an across the board percentage increase, say 8 percent or so. So they take last year’s book and increase selling prices 8 percent across the board. In most cases, however, key material prices have increased more than 8 percent so again, while they are recovering some of the price increases through selling prices, they are not fully recovering all of them.

If you are a flat rate company, take the time to make sure that all the material cost inputs in your book are current. It would be smart to build in some modest cushion in selling prices to account for price increases that happen before your next price book is printed. If you haven’t reprinted your book in the past six months, do it now.

2. Business mix changes have resulted in changed material expense percentages.

For many contractors, particularly small companies, business mix changes can result in dramatic differences in material percentage. For many contractors, one big commercial water heater job or a large heating installation in a given month can dramatically increase their material percentage. So in your case, if your material percentages are up due to work mix changes, you may be in good shape, if and only if your company’s direct labor percentages have decreased.

This is a very important point. If your direct labor percentage is typically 23 percent and your material percentage is 15 percent, and the next month your material percentage goes to 22 percent because of a big material-intensive job but your labor percentage stays the same - what have you accomplished? Increases in material-intensive jobs should result in significant decreases in direct labor percentages. If this is not happening in your company, you have some inefficiency in the field that needs to be addressed.

Here are a couple of general rules for work mix changes:

The proper way to handle material purchases is to buy material, move the material into inventory (on the company’s balance sheet) and then when the part is taken out of inventory and sold to the consumer, it is expensed on the income statement.

While most public company accountants would faint, the typical company expenses all materials when purchased from the supplier, even if the material is put into inventory to be sold at a later date. This is done due to lack of an inventory system that properly moves materials from the warehouse to the truck to the end- user. Getting this system in place is a huge job and is typically not the first place to start when building a business. So I am not necessarily recommending that it take place.

However, if your material percentages are up or down, it would be wise to consider what has happened to your inventory levels of materials. Have you made significant pre-season inventory purchases or outfitted a new truck and expensed all the new material purchased?

Purchasing (and then expensing) materials for inventory are very real reasons why your material line on your income statement is up in any given month. However, these short-term purchases tend to level off over the course of the year. So if your material expense percentage is up in the fourth quarter, don’t kid yourself. This probably isn’t the reason.

4. Material is being wasted or is “walking out the door.”

It is funny, but when material expenses are up, this is usually the first place contractors blame for a reason. It can’t be because of inattentive management.

It is usually not the reason. Sure, there is no doubt that companies with limited control of inventory in the warehouse or trucks lose material to both inefficiency - such as taking apart a new faucet for a part and then throwing the old faucet away - or theft for a side job for a “friend” who owns a couple of rental duplexes. However, the money lost here typically pales in comparison to not having the proper selling prices.

Don’t take this as a green light to ignore proper inventory controls. They are important and should be developed. But if you have runaway material expenses, don’t expect them to miraculously fix the problem.

When it comes to material expenses, your job as the owner is to completely understand what has caused your material expenses to change. Don’t assume you know, or hope “it will work itself out” over time. Get underneath the number and understand which of the four reasons listed above might be causing your material expenses to rise.

You’ll find a condensed P&L statement in Table 1. Let’s diagnose what is going on with this company.

If you look at the upper right corner of line 3, you will see that net revenue is up 7.9 percent or $115,000 over the prior year. So far, so good. The old business adage, “If you aren’t growing, you are dying,” is especially true in the service business.

The next stop is direct labor. You can see at the end of line 4 it is up only 6.1 percent. Along with revenue growth, this is more good news. We are gaining leverage on our direct labor expense. In other words, we’re becoming more efficient in the field. Direct labor as a percentage of sales is a healthy 22.4 percent, down slightly from the prior year’s 22.8 percent. So top-line revenues are moving up and labor percentage is moving down. I like it so far.

Let’s look at material. In 2007, material on line 5 represented 11.7 percent of sales. This year it has grown to 14.4 percent. So while revenues are up 7.9 percent, material expenses are up 32.4 percent. Yikes!

Now let’s see what this increase in material expenses has done to profitability.

Reviewing total overheads on line 8, you will see that they have gone up 8.6 percent year over year, just slightly more than revenue growth. This is pretty much in line. For the purposes of this example, I have condensed all these expenses that are typically segregated into many different expense categories such as vehicle expenses, overhead salaries, etc.

The net result, however, is the company made $20,000 less in profit (line 9), despite growing the business and keeping labor and overhead costs in line.

A lot of hard work went into growing the business and managing labor expenses (two very difficult tasks), only to give it all back plus $20,000 all on the material line.

Does this sound familiar? It is happening across our industry in recent years - material costs rising faster than sales and eating into company profits. How can this be?

Here are some possible reasons:

1. Material cost increases are not being fully passed on to the consumer in the form of higher selling prices.

This is the No. 1 reason for increased material percentages on the income statements I review. For several years, prices for common products such as copper pipe, PVC, fixtures, boilers, you name it, have risen dramatically. It seemed that contractors were getting price increases with every material order.

Compounding this problem is the flat rate pricing method used by most service companies. For many contractors, printing a new flat rate book is a time-consuming task. As such, it is done maybe twice a year - usually when all the existing copies are dog-eared and dirty or stolen by former employees. The result is contractors are using last year’s material expenses to build this year’s selling prices. A big problem.

Another mistake I have seen with flat rate contractors is that when they do print new books, they may just take an across the board percentage increase, say 8 percent or so. So they take last year’s book and increase selling prices 8 percent across the board. In most cases, however, key material prices have increased more than 8 percent so again, while they are recovering some of the price increases through selling prices, they are not fully recovering all of them.

If you are a flat rate company, take the time to make sure that all the material cost inputs in your book are current. It would be smart to build in some modest cushion in selling prices to account for price increases that happen before your next price book is printed. If you haven’t reprinted your book in the past six months, do it now.

2. Business mix changes have resulted in changed material expense percentages.

For many contractors, particularly small companies, business mix changes can result in dramatic differences in material percentage. For many contractors, one big commercial water heater job or a large heating installation in a given month can dramatically increase their material percentage. So in your case, if your material percentages are up due to work mix changes, you may be in good shape, if and only if your company’s direct labor percentages have decreased.

This is a very important point. If your direct labor percentage is typically 23 percent and your material percentage is 15 percent, and the next month your material percentage goes to 22 percent because of a big material-intensive job but your labor percentage stays the same - what have you accomplished? Increases in material-intensive jobs should result in significant decreases in direct labor percentages. If this is not happening in your company, you have some inefficiency in the field that needs to be addressed.

Here are a couple of general rules for work mix changes:

- Increases

in drain cleaning and sewer repairs should result in declining material percentages.

- Increases in service plumbing, remodeling and new construction normally result in increasing material percentages.

The proper way to handle material purchases is to buy material, move the material into inventory (on the company’s balance sheet) and then when the part is taken out of inventory and sold to the consumer, it is expensed on the income statement.

While most public company accountants would faint, the typical company expenses all materials when purchased from the supplier, even if the material is put into inventory to be sold at a later date. This is done due to lack of an inventory system that properly moves materials from the warehouse to the truck to the end- user. Getting this system in place is a huge job and is typically not the first place to start when building a business. So I am not necessarily recommending that it take place.

However, if your material percentages are up or down, it would be wise to consider what has happened to your inventory levels of materials. Have you made significant pre-season inventory purchases or outfitted a new truck and expensed all the new material purchased?

Purchasing (and then expensing) materials for inventory are very real reasons why your material line on your income statement is up in any given month. However, these short-term purchases tend to level off over the course of the year. So if your material expense percentage is up in the fourth quarter, don’t kid yourself. This probably isn’t the reason.

4. Material is being wasted or is “walking out the door.”

It is funny, but when material expenses are up, this is usually the first place contractors blame for a reason. It can’t be because of inattentive management.

It is usually not the reason. Sure, there is no doubt that companies with limited control of inventory in the warehouse or trucks lose material to both inefficiency - such as taking apart a new faucet for a part and then throwing the old faucet away - or theft for a side job for a “friend” who owns a couple of rental duplexes. However, the money lost here typically pales in comparison to not having the proper selling prices.

Don’t take this as a green light to ignore proper inventory controls. They are important and should be developed. But if you have runaway material expenses, don’t expect them to miraculously fix the problem.

When it comes to material expenses, your job as the owner is to completely understand what has caused your material expenses to change. Don’t assume you know, or hope “it will work itself out” over time. Get underneath the number and understand which of the four reasons listed above might be causing your material expenses to rise.

Links

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!