Let’s talk about the typical small business start-up for a minute. Whoever goes into business typically does not wake up one day and decide the next day to go into business.

Normally, the idea takes a few years to take root; in many cases, it may have been a life-long aspiration. In any event, it is something that is thought about for many years.

Finally, the decision to go into business is made. Before you quit your job, all your available free time is spent planning for the business launch. Many questions need to be answered, including:<

- How much cash in the bank will I need?

- What are the critical tools and equipment required to perform the work? When will they be acquired?

- What customers will I reach out to when I start my new business?

- How much should I charge?

- What will the name of the new company be and what is the focus of the business (residential, underground, commercial, etc.)?

- What will the sales and expenses be in the first year?

Not all this stuff happens in isolation. Ideas are bounced off family and friends.

Normally there is a pretty extensive circle of people who are brought into the process and asked for input - including a wife or girlfriend, a close friend, a brother and perhaps, if the soon-to-be owner is smart, a prospective customer or two.

The point I am trying to make is that before a wrench is even turned, a lot of thought and planning goes into critical decisions.

Then the day comes when all the planning is out of the way. You put up the shingle and off you go into business.

It feels great to finally put your plans into action. You get up early, stay late and hustle every day, making sure that the business you conceived is launched successfully.

Your friends and family - the same ones you asked for advice - inquire how the business is performing. Did that one idea you talked about work? They are rooting for you and you, of course, want to show them that you can do it. This causes you, perhaps without even knowing it, to work even harder.

And like all things in life, all the preparation in the world never fully prepares you for the real thing. Things pop up (normally expenses) that you never thought about. But for the most part, you are prepared and ready for the critical issues because you planned ahead of time.

The business is successfully launched. You are in business, making money, growing and pretty happy with yourself.

So why do most contractors stop planning and budgeting once their business takes off?

No one in his right mind would ever recommend starting a business without a well-thought-out business plan and budget. This is to make sure the business has the best chance of success. But once the business is launched, has traction, has vendors to pay and is employing people who depend on the business for their livelihoods, we stop doing one of the most important things that will help to ensure the business’ success.

Planning is necessary whether you’ve been in business for one or 100 years.

Are You Too Busy To Be Productive?

From my experience, the primary reason contractors don’t plan is that they are too busy running the business. They are doing, doing, doing, five, six even seven days a week.Running a business without a business plan results in an unfocused approach. If you are not careful, without focus and planning, the urgent takes the place of the important. Dousing daily fires becomes the norm, not the exception. Nothing proactive or business-building occurs. Jim Hamilton, my good friend and fellow Nexstar business coach, says, “Everyone is busy but no one is productive.”

It is important each day that your activities match up with the actions you have identified as important in your business plan.

Where Do I Start?

The good news is it really isn’t that hard and you don’t need to be a wizard at Excel to make a good budget - although it sure makes it a whole lot easier.The key is to keep it simple. First, start with the revenue side of your business. Brainstorm a complete list of revenue-generating ideas. Think in terms of lead generation, conversion rate and average sale. What can you do in the business that will affect one of these key performance indicators?

From that full list, cull it down to the vital few that you think will really move the sales needle. Now you have your key revenue generation ideas. Lay out the timing and actions that need to happen to bring these revenue increases to life.

With that out of the way, take a realistic look at the revenue impact each of them may have on your business. For example, what would a $20 increase in your average service ticket do for your revenue? Write down that number. Add up the impacts of all your revenue initiatives - add them to prior year numbers, massage them a little bit more and you have a revenue budget. A simple example is found in Table 1.

Key Revenue Initiatives

- 1. Raise average sale by $20 from 5 percent

price increase effective Jan. 1. Estimated impact is

$45,000.

2. Replace one technician who has a low conversion rate. Increase conversion rate by 1 percent. Estimated revenue impact is $20,000.

3. Add pay-per-click Internet campaign for plumbing key words by April 1. Cut Yellow Pages advertising in secondary books effective June 1. Estimated revenue impact of $35,000 for both moves.

4. Hold weekly sales class with technicians on Wednesday.

5. Read two books on sales management to learn more on how to manage technicians.

Keep Direct Expenses In Check

Now take a hard look at your direct labor and material expenses. Initiatives to keep these numbers in check or improving must be a part of your business plan in order to maintain a healthy, profitable business.What can you do to bring these important percentages down? Dispatch from home, create new productivity incentives, whatever. Spend a lot of time here making sure you can keep these expenses under control. They likely already represent 40 to 50 percent of sales; if they get out of control, you may lose any benefit from the revenue increases you may earn.

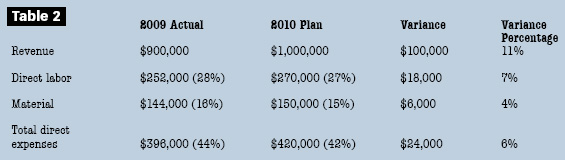

They may look like those in Table 2.

Key Direct Cost Initiatives

- 1. Dispatch techs from home on

Tuesday, Wednesday and Friday starting Jan. 15.

2. Install GPS systems in trucks. Check arrival and departures against time sheets for accuracy starting March 1.

3. Implement field purchase order process for nonstock items. Have warehouse personnel run parts as necessary to limit tech supply house visits. Start ASAP.

4. Create technician sales incentive to reward billable hour production by Feb. 1.

Review Overhead Expenses

Now look at our budgeted revenue and the increases you are projecting. What investments does your company need to make in terms of employees, trucks, equipment, advertising, etc., in order to hit your planned numbers? Look at what you are currently spending and then go line item by line item and create new budgets for each, including the investments you will make.Look hard at vehicle, advertising and office salaries when doing your budget and make sure that all the spending makes sense. These are the three biggest overhead expense items service contractors have, so these need to be reviewed closely and managed tightly.

Bring It All Together

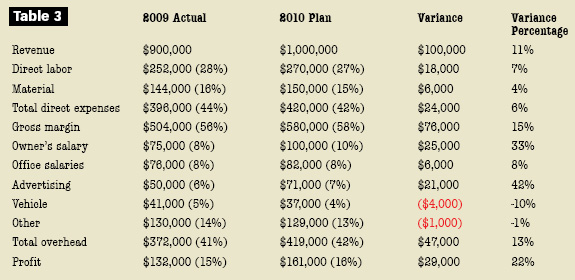

After you have reviewed and planned for revenue, direct costs and overhead, you bring them all together.Table 3 is a very simplified view of how a business plan and a budget could look. This is abbreviated and simplistic compared to many budgets with Excel Pivot Tables showing cash flow projections, payroll expenses by day, etc. Those are great, but at the heart of those business plans and budgets is what we have in Table 3 - what the revenue and expense projections are and how we are going to get there.

Key Overhead Initiatives

- 1. Decrease Yellow Pages advertising

by $15,000. Add $30,000 in Internet advertising and $6,000 for two home

shows.

2. Purchase GPS system for $3,000.

3. Cut yard maintenance and pest control - perform in-house with warehouse personnel. Savings of $4,000.

4. Increase owner’s compensation by $25,000.

5. Provide 5 percent salary increase for office personnel.

6. Shop health insurance with expected savings of $4,000 annually.

7. All other expenses have been increased 2 percent for anticipated cost increases.