When I learned the power of financial reports, well, it was a spiritual experience for me. My eyes were opened! I could see the error of my ignorant ways! I walked into the LIGHT! And I was saved from certain financial damnation. Amen.

Before I was saved, I spent a lot of time wandering in the darkness. When I first started with my husband Hot Rod's plumbing and heating company, he kept the financial information in a red notebook with columnar pages. Remember those? I faithfully recorded the checks and the invoices and always wondered why we didn't have any money.

Before I was saved, I never looked at financial statements - the balance sheet and the income statement. What was the point? The only thing I understood was the bottom line - and our bottom line had brackets around it. Once I suggested we save money by firing our accountant. We didn't look at the reports she generated at the end of the year anyway. At the time, I would have preferred to stick a sharp needlenose pliers in my eye than figure out assets, liabilities and equity.

But I had to do something because we were drowning. I had to learn how to make money. So, I struggled through. And I started to make sense of our financial predicament. It wasn't easy for me. I have the attention span of a gnat. I get a headache looking at columns and rows of numbers.

Then, I saw the light. By confronting the numbers, I realized we were charging less than it was costing us to be in business. Therefore, there was one way to turn our business around. I was born again!

I convinced Hot Rod we needed to raise (quadruple) our prices. He was agreeable, as he was tired of working so hard for so little. We raised our rates and the financial reports improved. We started to pull the company out from under the hellish waters of debt and over-due supply house bills! Hallelujah!

At the end of the month, I would trot out the income statement to show Hot Rod how we were doing. I'd cover his desk with pages and pages of financial reports. His eyes would glaze over.

One day he sighed and said, "I really hate this. I'm glad you know what all this means, but I can't take all this information. Can you just show me the few numbers that make all the difference in our company? Can you give me the Reader's Digest version?"

Hmmm.

Financial Statements -- The Reader's Digest Version. What a concept!

When it comes right down to it, there really are only a few numbers that make all the difference. If there is a problem with one of the key numbers, well, you can dig deeper and get more information. If you were to watch a few critical numbers at your company, you would have a pretty good idea of what is going on. You would know for certain whether or not you are making any money. You would know if you are going to have enough money to cover payroll.

Hot Rod was on to something.

Gail Gudell is a professional organizer and bookkeeper par excellence. She is also my sister. Gail started working with us many years ago, and is one of the reasons Hot Rod and I didn't kill each other in our early days of working together. Gail and I sat down, determined to put the few numbers that make all the difference on a single sheet of paper. This is what we came up with.

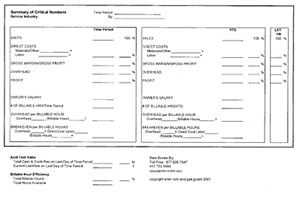

The Summary Of Critical Numbers

This simple, powerful form culls the most important financial information from the balance sheet and income statement. It includes billable hour information, too. Feel free to customize this form. It's a basic format. What's important is that you are looking at key numbers every week. (Every day if you are ambitious!)If your accounting program allows you to assemble a neat, consolidated report like this, great! But don't be a snob about this manual form. It will confront you with the data, and that's how you break out of denial - the denial that keeps you from charging as much as you should.

This form is set up to compare a period of time - like a week or a month - to the year-to-date (YTD) totals. You could also use the right side of the form to list budgeted information for the same period of time, and compare actual to budgeted.

Note the percentage columns. Numbers vary from day to day and week to week. Percentages present a clearer picture of trends and performance. By tracking critical numbers as a percentage of sales, you can assess data from different time periods. Makes it easy to see if you are on track, or way off.

We decided to specifically list Owner's Salary paid as a line item on this form. The owner is the first person to take a pay hit when the going gets tough. Sacrificing your life for your business is NOT all right. If you aren't making any money doing the wonderful work that you do, I want you to be uncomfortable about that, and make some changes.

Ratios

"The Acid Test" matches cash and accounts receivable against current accounts payable. If you have $20,000 in cash and $40,000 in accounts receivable, and $30,000 in accounts payable, your acid test ratio is:- $20,000 + $40,000 = $60,000

$60,000 / $30,000 = 2.0 or 2 to 1

The beauty of knowing this ratio is it will kick you in the butt to collect! Also, moving to collect-on-delivery (COD) terms will dramatically improve this ratio - and your cash position.

Billable-hour efficiency is a productivity measure. In the plumbing industry, you are bound by time. Your real value to the marketplace is not your ability to supply material. Home Depot does a good job of that. Your ability to make the materials work is what makes you valuable in the eyes of the consumer. And your skill, knowledge and expertise take time.

Gather billable hour information from your time cards and invoices. Ideally, the number on this form is the number of hours actually billed to customers. Even if you charge flat rate, you can figure the number of hours billed out every day.

Calculate the number by dividing the number of hours billed to the number of hours paid to the plumber. Keep an eye on this number. The more efficient you become the more money you can make.

Breakeven

If you fill out this form every week, month, year, and look at a breakeven per hour number that is more than what you are charging, I know what's happening. You are going deeper and deeper into debt.What to do?

The numbers tell you the score. They don't tell you what you should do to make the score better. So, what to do if the numbers aren't what you want them to be?

Get the top line where it needs to be. I suspect 99 percent of you reading this need to raise your prices. Sure, there are ways to reduce costs, or better-manage inventory. You'll find pennies of profit that way. The real winners understand that the top line - Sales - has to be big enough to cover all the costs of doing business, including reasonable compensation and benefits for you and your employees. There has to be enough on the top line to end up with healthy net profits on the bottom line. Get the top line high enough, and lots of problems go away.

You could create something like this in Microsoft Excel. You could create a program that does the calculations automatically. Or, you or your bookkeeper can fill in the numbers by hand from your timesheets, sales reports, balance sheet and income statement. Keep it simple.

Use this form to teach financial basics to your employees. Use it to show them why you need to charge what you charge. Too much financial information can be overwhelming. This form is just the right size. Uncomfortable sharing owner's salary with your employees? You can take that line off the form. Frankly, I suggest you go ahead and share that information. They think you are making millions of dollars anyway.

You might want to create a form like this for each department at your company. You could customize a form like this to keep track of a big project. You could add numbers for callbacks, customer complaints, compliments or safety violations. Keep it simple and real. Be consistent with your tracking. The data will set you free.

May your eyes be opened and your finances healed!