In researching this annual Pipe Trades Giants issue, I always discover tidbits of information and insights that don't necessarily fit together into a coherent narrative, but which nonetheless shed light on our industry and its major players. Here are some of the stories behind the numbers.

Consolidation is dead. Long live consolidation.

What I mean is that the roll-up era is over for as far ahead as anyone can see. Wall Street finally saw through this shell game and gave it a ruthless thumbs down. You won't see anyone else trying to build mechanical contracting empires for their own sake. Even if someone smokes something potent enough to want to give it another try in this industry, the money isn't there anymore. Venture capitalists are lying low.But this doesn't mean consolidation is over. The companies on this Giants list aren't going to devolve into thousands of mom-and-pop shops. Consolidation is taking place at every level of the PHC industry -- among manufacturers, wholesalers, engineering and rep firms. Contracting is not immune to this inexorable business trend. Size does confer advantages; otherwise we wouldn't see consolidation taking place not only in this industry, but also throughout the U.S. economy.

However, there is a difference between consolidation as a way to manipulate the stock market, and consolidating to boost operations. Not many acquisitions are taking place these days, mainly because the companies that went on buying sprees the previous five years are trying to digest those companies. Plus, as noted, they don't have much cash left to throw around.

Consolidation will probably be less of a factor in the residential sector than in the larger commercial-industrial arena. Small neighborhood firms still seem capable of taking care of America's home repair and maintenance needs, but on large construction projects bonding capacity is an acute concern. Many small mechanical contractors are unable to pass muster in a tightening surety market. This alone will help drive consolidation.

Also, there is still plenty of room to consolidate. Mechanical contracting is an extraordinarily fragmented industry. Investment researchers at Stifel, Nicolaus & Co. estimated that the top 100 mechanical contractors capture only around 19 percent of the market.

Keep an eye on the utility subsidiaries. In general, things haven't panned out the way the utility companies figured with their forays into both residential and commercial mechanical services. Yet, the underlying marketing synergies remain. Utility companies have faced a bunch of trouble unrelated to their contracting operations, which are little more than afterthoughts compared with their energy generation and trading activities. It's hard to find signs they are fed up with this business.

What's EMCOR doing right?

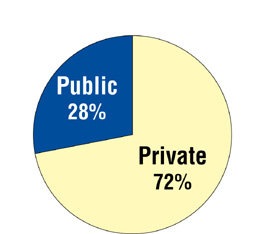

Among the handful of large public mechanical contracting companies, EMCOR stands tall amid the ruins. Although Encompass Services Corp. lays claim to the largest revenue volume overall (including electrical, facilities management and other types of work), we peg EMCOR as the largest company in pipe trades volume. More important, EMCOR is a shining star to the investment community. Whereas Encompass has seen its stock price plummet to around a half a buck and Comfort Systems struggles below $5, EMCOR was trading at $56 as of this writing.EMCOR was formed in 1994 from the remnants of the bankrupt JWP conglomerate. They absorbed some of the strongest remaining assets and were unencumbered by the junk. In the ensuing years, EMCOR made some notable acquisitions, such as Baltimore's Poole & Kent Co. in 1999, but unlike the roll-up artists, they were studied transactions rather than growth for growth's sake. As a result, EMCOR has grown strategically and operationally, and is in a relatively strong cash flow position.

By way of contrast, Encompass and Comfort Systems are roll-up progeny. Although some fine companies and personnel still do business under their umbrella, the companies are depleted of cash and struggling to integrate disparate acquisitions into a cohesive corporate whole.

Comfort Systems recently sold its union companies, some 19 affiliates in all, to EMCOR as part of its struggle to shore up its finances and bring some rationality to its operations. The stock market has responded positively, with the company's share price more than doubling from its post-9/11 nadir of around $2. The company still has a long way to go to be labeled a success story, however.

The most curious of the roll-up consolidators is AMPAM. It is the only one of the bunch that staked out new construction as its primary turf rather than the service market (see "Strength In Diversity," January 2002). It has built itself into an organization of considerable size mostly through acquisitions. While not setting the industry on fire, AMPAM seems to be holding its own thanks to a residential construction market that refuses to die.

AMPAM acts like a public company in the way it sends out quarterly financial press releases, and still wants to be one if IPO prospects ever get beyond the wishful thinking stage. My impression of this company is they are riding the wave of the construction market, but if home building takes a nosedive, they could face big trouble.

Watch the ServiceMaster-Home Depot alliance.

The residential consolidators have mostly been flopping around like fish out of water. Blue Dot seems to lack any strategic vision, Service Experts is now part of Lennox, the R. S. Andrews empire is a dream never come true, and PSI has put its roll-up quest on a far back burner.Most intriguing of the residential consolidations is ServiceMaster's ARS/Rescue Rooter unit. ServiceMaster still makes an occasional PHC acquisition, but mostly has spent the last couple of years trying to integrate its acquired companies into a cohesive corporate culture.

Especially interesting was the announcement last November of an alliance between ServiceMaster and Home Depot to test the sale of PHC and other co-branded residential maintenance and repair services to Home Depot's retail customer base.

Installed sales have been a thorn in the side of the big boxes for a number of years. Being of sound mind, executives at Home Depot and Lowe's don't want to enter the service contracting business, but neither have they been able to figure out a way to give their customers decent installation service while working with independent contractors. In ServiceMaster, Home Depot found a partner of desirable name recognition, character and size. It's only a pilot program, but if it proves workable, it could breathe some life into the residential consolidation movement as Lowe's and other retailers look to counter with their own service alliances.

Some have speculated that Home Depot could end up buying ServiceMaster. While not illogical, my thinking is that if the Home Depot/ServiceMaster alliance pans out, Home Depot won't need to spend billions buying its own service company with all the attendant headaches. I suspect it more likely they'd look to buy a service empire if the ServiceMaster arrangement doesn't meet their expectations.

Hooray for boring businesses.

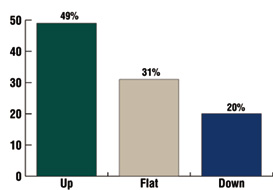

I write this in late June, just a few days after the WorldCom scandal hit the front pages. This story comes on the heels of the Martha Stewart insider trading flap and the indictment of Tyco's former CEO, which followed on the heels of a dozen or so other tales of corporate malfeasance, of which of course the name Enron is destined to live in infamy. And all of these followed not too long after the collapse of the dot.com bubble where so much wealth chased so little substance. In response, the stock market has been tanking this week to levels not seen since the immediate aftermath of 9/11.With so much of corporate America in the hands of shifty scoundrels, a lot of people are waxing nostalgic for the good old days when business growth and profits were grounded in things of real value. Mechanical construction and services fit that description as well as any business does.

Consider something I read in a newsletter published by the investment-banking firm of Houlihan Lokey Howard & Zuhn (www.hlhz.com). It was part of their assessment of the engineering and construction (E&C) sector of the economy:

"Long lead times for projects, traditional services, heavily negotiated contracts, reliance on public-sector funding and other factors all reinforce the Old Economy, slow-to-change image of the E&C sector. While the stodgy nature of the E&C sector inhibited valuations in the past, it bolsters the sector in today's post-Internet, post-Enron climate."

Plod on, all you stodgy construction and service companies. People have spent a lot of money in recent years on businesses based on smoke and mirrors. Maybe they'll start to realize the value of companies that actually build and fix things.